Tax Withholding Changes

Virtual Process for Tax Withholding Changes

Cal Employee Connect (CEC) is used to make any tax withholding changes state employees wish to make. If you have not registered for CEC, now is the time. You can change your tax withholdings using CEC Employee Services feature and Multifactor Authentication (MFA). The Employee Services feature is secure, user friendly and has been created as additional options to support remote work and employee self-service. MFA allows for an extra layer of security on employees CEC accounts and must be enabled for employees to make withholding changes using CEC. Once MFA is enabled, employees can change their tax withholdings via the Employee Services feature within CEC.

Employees may wish to use the Net Pay Calculator (XLS) to help determine how a change could impact their monthly net income.

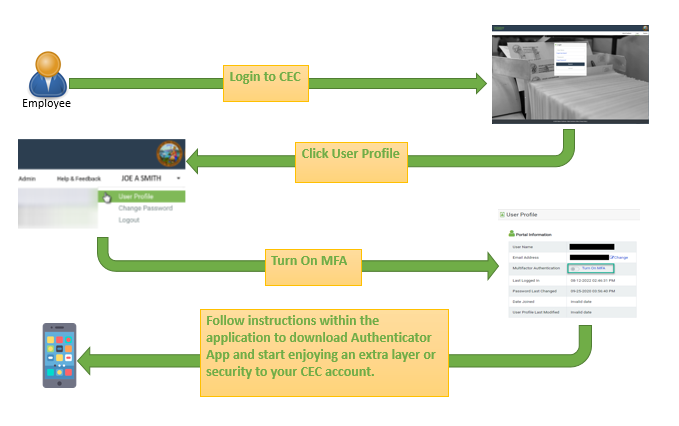

Withholdings Multifactor Authentication (MFA)

- Multifactor Authentication is an additional level of security that an employee sets up on CEC It uses a phone-based application to generate security codes to add another layer of verification to your account. More information about MFA is available here (PDF). To submit a Tax Withholdings Change via Cal Employee Connect, you will need a MFA linked to your CEC account.

- An additional User Guide is available on MFA setup with the “Resources” section of the Connect - Help and Feedback

To view your current tax withholding status, follow these steps:

- Login to Cal Employee Connect

- Click on 'Earnings' tab

- Click on most recent Earnings Statement

- View 'Tax Status' in Earning Statement Detail

To request a change to your tax withholding status, follow these steps:

Step One - Getting Started:

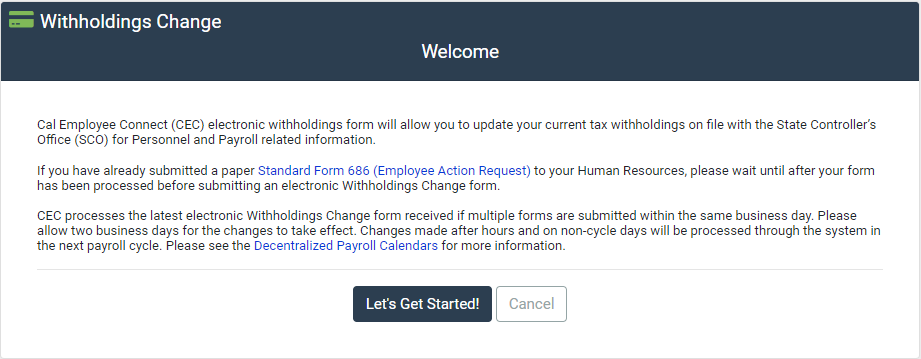

- Login to a CEC account with MFA enabled. CEC’s electronic Withholdings Change form is an alternative to the Employee Action Request (EAR) and allows employees to update their tax withholding information via a CEC account.

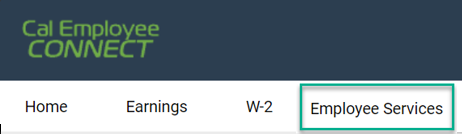

- The Employee Services feature allows employees to self-service with the submission of electronic forms via CEC. To update Tax Withholdings via CEC, navigate to the “Employee Services” section.

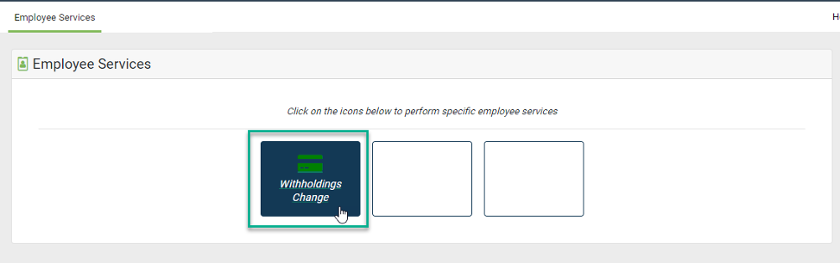

- Within the “Employee Services” section, select “Withholdings Change” from the available options.

- CEC prechecks for Tax Withholdings Change availability. If CEC is unable to confirm an account’s status, CEC will provide information on how to obtain additional assistance. If an account has not yet enabled MFA, they will be directed to do so before they can proceed with a Withholdings Change via CEC.

- Before starting the Withholdings Change form, CEC will provide additional information and resources.

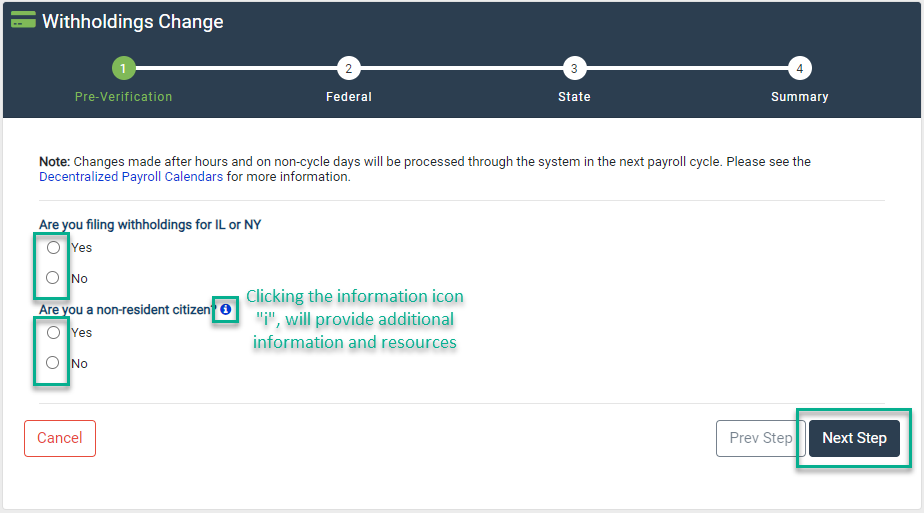

Step Two – Pre-Verification:

- The Pre-Verification section has qualification questions that are a requirement for submitting an electronic Withholdings Change form. If additional assistance is needed CEC will direct the employee to the California Personnel Office Directory (CPOD) and to contact their Departmental HR office.

- Please note, additional information is available by clicking the “i” icon next to most questions.

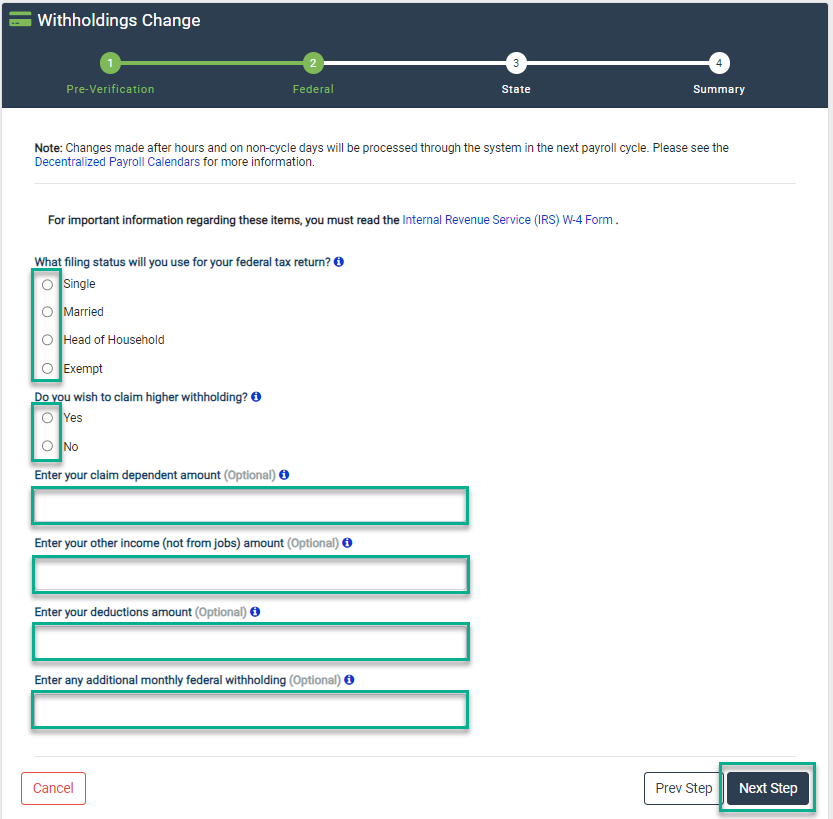

Step Three – Federal:

- The Federal Withholdings section will expand as the form is populated. Questions will have additional information and linked resources available by clicking the “i” icon.

- After completing the form with the appropriate information, click “Next” at the bottom of the page.

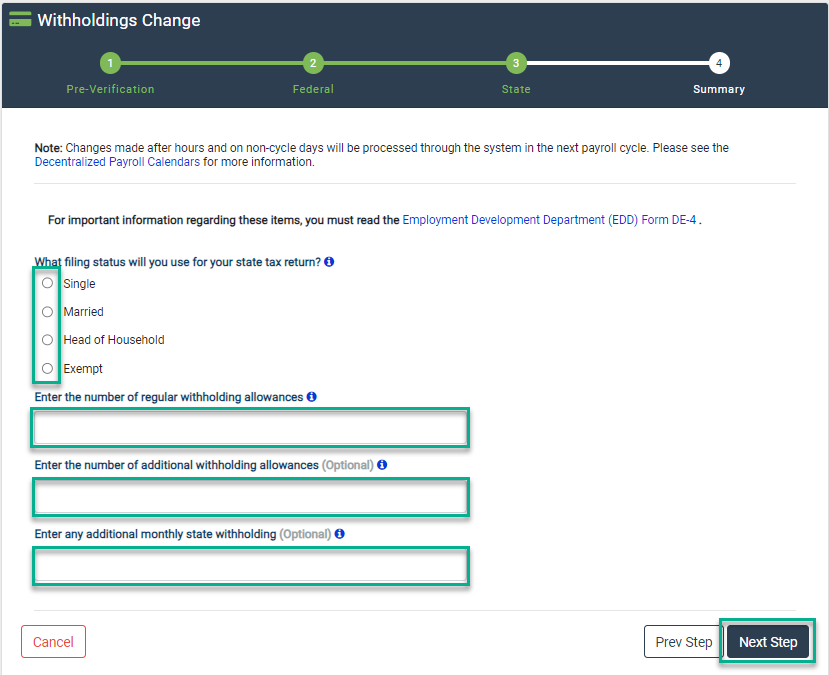

Step Four – State:

- The State Withholdings section will expand as the form is populated. Questions will have additional information and linked resources available by clicking the “i” icon.

- After completing the form with the appropriate information, click “Next” at the bottom of the page.

- If additional edits are needed on a previous section of the Withholdings Change form, the “Prev Step” and “Next Step” buttons at the bottom of the form can be used to toggle between parts of the Withholding Change.

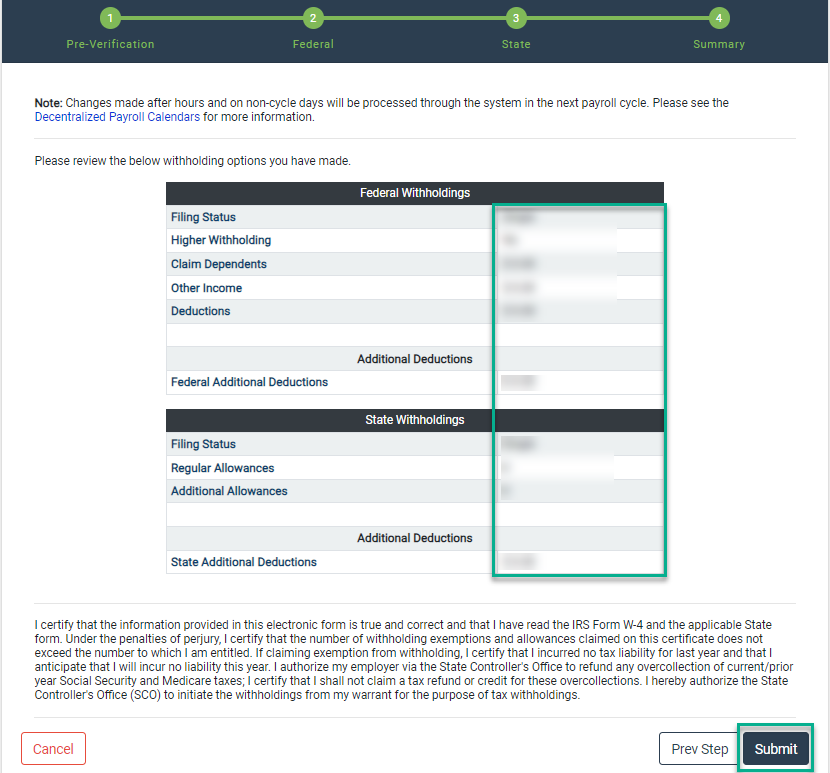

Step Five – Submission:

- A quick summary of the entered information is provided, allowing for a review and opportunity for additional changes.

- After reviewing the entered Withholdings updates, read the authorization statement at the bottom before clicking the “Submit” button.

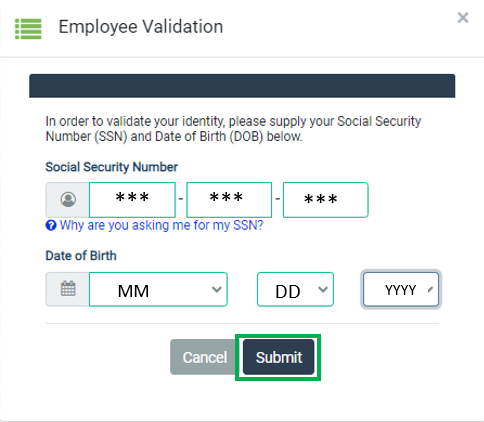

- To validate the Withholdings Change, a Social Security Number and Date of Birth are used as an electronic verification.

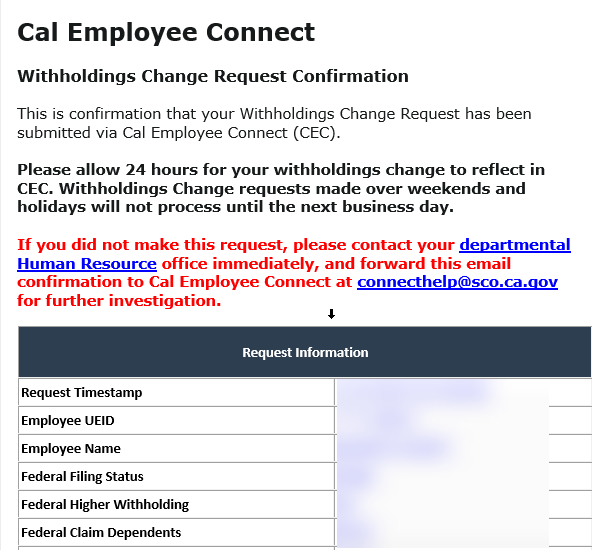

- After submitting a Withholdings Change via CEC, the employee and the "Departmental HR Office" (this is the campus Payroll office) will receive an email confirmation on a submitted Withholdings Change form. Please note, the confirmation will be directed to the email currently linked to the CEC account.

Note:

- CEC processes Withholdings change requests by close of business Monday through Friday; please allow 24 hours for submitted changes to reflect in your CEC account. If the change is submitted Friday evening through Sunday, the changes will be processed the following Monday and changes may reflect in your CEC account as early as Tuesday morning.

- If Exempt is claimed on the Withholdings form, this exemption will automatically expire on February 15th of the next year unless they file a new certification by January 31st of the next year.

- The CEC Team is a technical team and unable to advise on withholdings change. If you have any questions regarding your Withholdings change, please refer to the IRS website.

For technical questions or technical assistance with the Withholdings Change feature, please contact the CEC team atHelp & Feedback.