Econ Minor Catalog Info(opens in new window)

2020 Honors Students Abstract of Research

The Fertility Recession: Understanding Birth Rate Trends in Light of the Recent Financial Crisis

Research completed by David Sweeten, graduated 2020 with Honors in Economics.

Abstract of research: It is well known that the U.S. economy went through much turmoil during the Great Recession that began in 2007. But what is not as commonly understood is how the economic recession accompanied a “fertility recession”-- a drop of considerable magnitude in the average number of births per 1000 fertile women in a year. The great puzzle of this phenomenon is how the fertility rate fell with the economy, but did not appear to have recovered with it. I investigate the dynamics of population and fertility throughout modern history and how these dynamics affect and are affected by economic conditions in the United States.

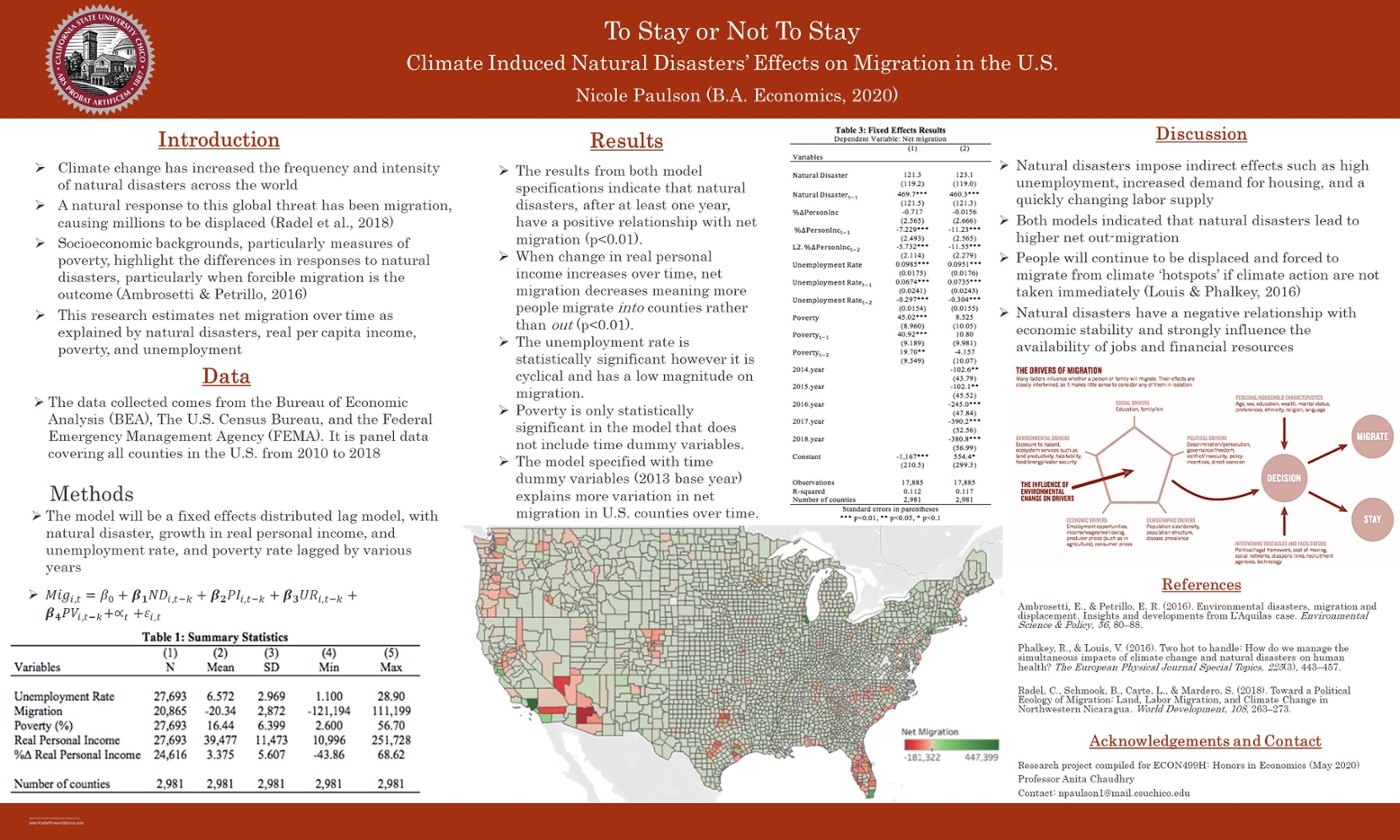

To Stay or Not to Stay: Climate Induced Natural Disasters’ Effects on Migration in the U.S.

Research completed by Nicole Paulson, graduated 2020 with Honors in Economics.

Abstract of research: Natural disasters, such as storms, fires, floods or hurricanes, are sudden shocks to the economy with long lasting effects. One of those effects is human migration to and from the area affected by a natural disaster. Human displacement after natural disasters restructures local economies, and not being adequately prepared for these changes can lead to serious economic implications for disaster-hit areas. I investigate the effect of natural disaster on net migration in the United States. As natural disasters overwhelmingly increase in frequency and intensity, policy for alleviating large influxes of displaced people must be considered.

The Burning Questions: Studying the Effect of Wildfire on Employment Outcomes Across Sectors in California

Research completed by Reilly Lombardi-Hackett, graduated 2020 with Honors in Economics.

Abstract of research: Wildfires in California are becoming increasingly common and intense. Decision makers at all levels are being faced with difficult decisions regarding protecting the socioeconomic health of communities impacted by wildfires. Additional insight into the impact of wildfires on local labor markets will be an important addition to the ongoing discussion around wildfire responses throughout the State and help us develop a more targeted recovery policy. I use fixed effects panel data regressions at a quarterly-sectoral level for California counties to isolate the impact of fires on employment and wages.

Driving Under the Influence: The Relationship between Marijuana Legislation and Traffic Fatalities

Research completed by Nicholas Shi, graduated 2020 with Honors in Economics.

Abstract of research: This research explores the effect of decriminalization and legalization of marijuana on traffic fatalities in the United States. After a comprehensive research of marijuana laws across the United States, I group marijuana legalization into four stages. The results show that current marijuana legislation in the State influences traffic fatalities and behaviors related to traffic fatalities depending on the stage the State is in and transitioning into.

Yet Another Scarcity Premium: An Analysis on the Cost of Overnight Lending

Research completed by Marissa Thomas, graduated 2020 with Honors in Economics.

Abstract of research: The shadow banking sector has altered the credit creation process with significant effects on the real economy. The consequences that have taken place since have led to an evolution of monetary policy. For instance, trillions of dollars spent on the acquisition of non-traditional financially engineered assets. Leading to the effects of an enlarged balance sheet that seemingly spills into the economy. Thereby pushing the prices of collateral past their fundamentals. Such as, what was witnessed in the repo market in September 2019. Furthermore, the purpose of this study is to measure the premium that has been added to treasury collateral within the repurchase market (repo). Results indicate the existence of a statistically significant premium being added to off-the-run securities.